Preschool STEM fosters exploration of size, length, and weight, encouraging comparisons like describing siblings as “little” or “big.”

These activities build foundational skills!

What is STEM and Why is it Important for Preschoolers?

STEM—Science, Technology, Engineering, and Mathematics—isn’t about creating future scientists solely; it’s about cultivating critical thinking, problem-solving, and a playful approach to learning. For preschoolers, STEM activities naturally emerge during play, like comparing object sizes or building with blocks.

Early STEM exposure builds a foundation for future academic success, fostering curiosity and resilience when facing challenges. These experiences aren’t just about facts; they’re about how children learn and approach the world around them, preparing them for real-world problem-solving.

Benefits of Early STEM Education

Early STEM education significantly boosts cognitive development in preschoolers. Activities like building and experimenting enhance problem-solving skills and spatial reasoning. Exposure to STEM concepts encourages children to ask questions, investigate, and think creatively – skills vital across all learning areas.

Furthermore, STEM fosters collaboration and communication as children work together on projects. These experiences build confidence and prepare them to tackle complex challenges, nurturing a lifelong love of learning and exploration, setting the stage for future academic and career success.

Measurement STEM Activities

Measurement activities help preschoolers explore size, length, height, and weight through comparing objects and attributes, building essential skills.

Comparing Sizes and Lengths

Engaging preschoolers with size and length comparisons is fundamental to early STEM development. Activities should encourage descriptive language – “bigger,” “smaller,” “longer,” “shorter.” Children naturally compare themselves to siblings, noting who is “little” and who is “big,” providing a relatable starting point.

Introduce simple comparisons using everyday objects: blocks, crayons, or even shoes. Ask questions like, “Which block is taller?” or “Can you find a crayon longer than this one?” This builds vocabulary and observational skills. Facilitate exploration, allowing children to directly compare and contrast lengths and sizes independently.

Exploring Weight and Balance

Introducing weight and balance to preschoolers involves hands-on exploration. Encourage children to lift and compare objects, using descriptive words like “heavy” and “light.” Simple activities can involve comparing the weight of a book versus a feather, or a block versus a cotton ball.

Balance exploration can be introduced using a simple seesaw or a ruler balanced on a fulcrum. Observe how adding weight to one side affects the balance. This fosters understanding of physical properties and cause-and-effect relationships, crucial early STEM concepts.

Using Non-Standard Units of Measurement

Non-standard measurement introduces the concept of quantifying length and size without relying on rulers or scales. Preschoolers can measure objects using blocks, linking cubes, or even their hands and feet! For example, “The table is six blocks long.”

This approach emphasizes the process of measurement rather than precise numbers. It builds foundational understanding of comparison and estimation. Encourage children to articulate their findings, fostering mathematical language and problem-solving skills. It’s a playful introduction to measurement principles!

Building and Construction STEM Activities

Block building and construction play offer opportunities to handle challenges, mirroring real-world problem-solving. Experimentation and instructive plays are key!

Block Building Challenges

Presenting preschoolers with specific block building challenges ignites their engineering minds! Encourage them to construct the tallest tower possible, focusing on stability and balance. Or, task them with building a bridge strong enough to hold small toys.

These activities aren’t just about stacking blocks; they’re about problem-solving, spatial reasoning, and understanding structural integrity. Observe how children approach these challenges – do they plan, experiment, or collaborate?

Introduce constraints, like using only certain block shapes or limiting the building time, to further enhance the challenge and promote creative thinking. This fosters resilience and adaptability.

Creating Structures with Different Materials

Expand beyond traditional blocks! Offer preschoolers a variety of materials – straws, pipe cleaners, marshmallows, toothpicks, cardboard boxes, and tape – to construct structures. This encourages experimentation and innovative thinking.

Challenge them to build a house for a small toy, a tower that won’t fall, or a vehicle that can “travel.” Observe how they adapt their building techniques based on the material’s properties.

Discuss which materials are strong, flexible, or lightweight, introducing basic engineering concepts. This hands-on exploration fosters problem-solving skills and creativity.

Engineering Simple Machines with Blocks

Introduce simple machine concepts using blocks! Demonstrate how an inclined plane (a ramp built with blocks) makes lifting objects easier. Explore levers by balancing a block on a smaller block.

Challenge preschoolers to build a block “machine” to move a small toy from one location to another. Encourage them to experiment with different configurations and observe the results.

Discuss how these simple tools help us do work. This playful introduction to engineering principles builds critical thinking and problem-solving abilities.

Chemistry STEM Activities

Explore basic chemistry with a classic baking soda and vinegar volcano! This fizzing reaction is a fun, hands-on introduction to chemical reactions for preschoolers.

Baking Soda and Vinegar Volcanoes

Creating a baking soda volcano is a wonderfully engaging chemistry activity for preschoolers! It introduces fundamental concepts like chemical reactions in a safe and visually exciting way. Simply mix baking soda within a small container – a plastic bottle works perfectly – and then add vinegar.

Observe the dramatic fizzing eruption! This simple experiment sparks curiosity and allows children to witness a tangible reaction. Encourage discussion about what happens when the two substances combine, fostering early scientific thinking and observation skills. It’s a classic for a reason!

Exploring Mixing and Reactions

Preschool STEM extends beyond volcanoes! Encourage children to explore what happens when different materials are combined. Simple activities like mixing paints demonstrate color changes, a visible reaction. Observe what occurs when water is added to sand – does it change the texture?

These explorations build foundational understanding of cause and effect. Prompt questions like, “What do you think will happen if…?” to foster prediction skills. Document observations; this cultivates scientific thinking and lays the groundwork for more complex chemical concepts later on.

Simple Color Mixing Experiments

Preschool STEM offers vibrant learning through color! Introduce primary colors – red, yellow, and blue – and let children experiment with mixing them. Observe what happens when red and yellow combine to create orange, or blue and yellow make green.

This hands-on activity introduces basic chemistry concepts and encourages observation skills. Discuss the changes they see, prompting questions like, “What happened when we mixed these colors?” Document the results; this reinforces learning and builds scientific thinking.

Patterning and Sorting STEM Activities

STEM encourages identifying and extending patterns, while sorting objects by attributes develops critical thinking skills. Use diverse materials for engaging practice!

Identifying and Extending Patterns

Preschoolers naturally explore patterns in their world, and STEM activities can intentionally build upon this innate curiosity. Begin with simple AB patterns – red, blue, red, blue – using manipulatives like blocks or colored beads. Encourage children to identify the repeating unit.

Then, challenge them to extend the pattern. “What comes next?” is a powerful question. Progress to more complex patterns like ABCB or AABB. Introduce patterns through songs and rhymes, linking auditory and visual learning. Observe how children approach the task – do they count, visually scan, or use other strategies?

Sorting Objects by Attributes

Sorting is a fundamental STEM skill, developing logical thinking and categorization abilities in preschoolers. Provide a collection of diverse objects – buttons, blocks, toys – and ask children to sort them. Initially, offer a single attribute, like color. “Can you put all the red blocks together?”

Gradually introduce multiple attributes: shape, size, or material. Encourage children to explain their sorting rules. Observe their reasoning; are they flexible in their thinking? This activity builds vocabulary and problem-solving skills, preparing them for more complex STEM concepts.

Creating Patterns with Different Materials

Patterning introduces preschoolers to foundational algebraic thinking. Offer a variety of materials – beads, blocks, stickers, or even natural items like leaves and stones. Begin with simple AB patterns: red block, blue block, red block, blue block. Encourage children to extend the pattern.

Progress to more complex patterns like AAB or ABC. Ask, “What comes next?” Challenge them to create their own patterns and explain the rule. This activity enhances observation skills, prediction, and logical reasoning, crucial for future STEM success.

STEM Concepts Through Play

STEM seamlessly integrates into daily routines, dramatic play, and games, offering enriching experiences. At-home enrichment calendars provide more ideas and resources!

STEM in Everyday Activities

STEM isn’t confined to dedicated lessons; it’s woven into daily life! Consider mealtime – measuring ingredients introduces math concepts, while observing how foods change when cooked demonstrates chemistry. Building with blocks during free play fosters spatial reasoning and engineering skills.

Even simple activities like sorting toys by color or shape build foundational math skills. Encourage children to ask “what if?” questions and explore their surroundings with curiosity. These everyday moments are powerful opportunities for STEM learning, requiring minimal preparation and maximizing engagement.

Integrating STEM into Dramatic Play

Dramatic play is a natural avenue for STEM integration! A play kitchen becomes a testing ground for measurement (filling cups) and volume (comparing sizes). Building a “vet’s office” encourages observation, classification of animals, and problem-solving (diagnosing “illnesses”).

Constructing a “store” involves counting, money management, and understanding quantities. Encourage children to design and build props, fostering engineering skills. These scenarios allow children to apply STEM concepts in imaginative, real-world contexts, making learning playful and meaningful.

Using Games to Teach STEM Concepts

Games are powerful tools for introducing STEM concepts to preschoolers! Simple sorting games build classification skills, while building block challenges encourage spatial reasoning and problem-solving. Board games involving counting and pattern recognition reinforce mathematical thinking.

Even classic games like “Simon Says” can incorporate STEM – “Simon Says measure your height!” or “Simon Says find something heavier than this!”. Utilizing games transforms learning into an engaging and enjoyable experience, fostering a positive attitude towards STEM exploration.

Resources for STEM Activities

Online resources, activity calendars, and Facebook groups like “The STEM Space” offer enriching ideas and support for preschool STEM educators and families.

Online STEM Resources for Preschoolers

Numerous online platforms provide accessible STEM activities tailored for preschool-aged children. These resources frequently include printable worksheets, experiment guides, and video demonstrations, simplifying implementation for educators and parents. Many sites focus on playful learning, integrating STEM concepts into everyday activities.

Exploring these digital tools can significantly enhance a preschooler’s STEM education, offering diverse learning opportunities beyond traditional classroom settings. Furthermore, online communities, such as Facebook groups dedicated to STEM educators, facilitate the sharing of innovative content and effective teaching strategies, fostering a collaborative learning environment.

STEM Activity Calendars

Utilizing STEM activity calendars offers a structured approach to integrating science, technology, engineering, and mathematics into a preschool curriculum. These calendars often present daily or weekly themed activities, ensuring consistent exposure to STEM concepts. They can be particularly helpful for at-home enrichment, providing parents with readily available ideas to engage their children.

Many calendars are available online, offering a diverse range of activities suitable for various skill levels. These resources streamline planning and promote a continuous learning experience, fostering a love for STEM from an early age.

Facebook Groups for STEM Educators

Joining Facebook groups dedicated to STEM education provides a valuable platform for preschool teachers and providers to connect, collaborate, and share innovative ideas. These online communities facilitate the exchange of STEM content, effective teaching strategies, and research findings.

Educators can find support, ask questions, and discover new resources within these groups. The STEM Space Facebook group is a prime example, fostering a collaborative environment for continuous professional development and enriching STEM learning experiences for young children.

Adapting STEM Activities

STEM activities can be modified for diverse skill levels, offering at-home enrichment, and providing both offline and online learning opportunities for preschoolers.

Modifying Activities for Different Skill Levels

Adapting STEM challenges is crucial for inclusive preschool learning. Simplify tasks by providing more guidance or pre-cut materials for those needing support. For advanced learners, introduce open-ended questions, encourage independent problem-solving, and offer more complex materials.

Block building, for instance, can range from simple stacking to designing specific structures. Baking soda volcanoes can be adjusted by varying amounts of ingredients; The key is observation – noting where children struggle or excel – and then tailoring the activity to meet their individual needs, fostering both confidence and growth.

STEM Activities for At-Home Enrichment

At-home STEM learning can be seamlessly integrated into daily routines! Utilize everyday objects for exploration – building with blocks, sorting toys, or simple kitchen experiments like observing mixing and reactions. An “Enrichment Activities Calendar” can provide structured ideas, but encourage child-led discovery.

Both offline and online resources are valuable. Consider joining Facebook groups like “The STEM Space” for inspiration. Remember, the goal is playful learning, fostering curiosity and problem-solving skills through accessible, engaging activities that extend beyond the classroom.

Offline vs. Online STEM Activities

Offline STEM activities prioritize hands-on exploration – building, sorting, and experimenting with physical materials. These foster tactile learning and direct observation. Conversely, online STEM resources offer virtual simulations and interactive games, expanding learning opportunities beyond physical constraints.

A balanced approach is ideal! Combine building challenges with educational apps or videos. At-home enrichment benefits from both. Resources like activity calendars support both formats, while communities like “The STEM Space” on Facebook share ideas for both offline and online engagement.

Supporting STEM Teacher Development

STEM education requires innovative content sharing, effective strategies, and research. Programs reorganize to improve delivery, impact, and visibility, supporting diverse teachers effectively.

STEM Teaching Strategies

Effective STEM teaching for preschoolers centers on hands-on exploration and play-based learning. Encourage questioning, experimentation, and collaborative problem-solving. Facilitate activities that integrate multiple STEM disciplines – for example, building a tower (engineering) and measuring its height (measurement).

Provide open-ended challenges with various materials, allowing children to test ideas and learn from failures. Support diverse learners by adapting activities to different skill levels. Leverage everyday experiences, like cooking or playing, to introduce STEM concepts naturally. Remember to document observations of children’s STEM skills during play!

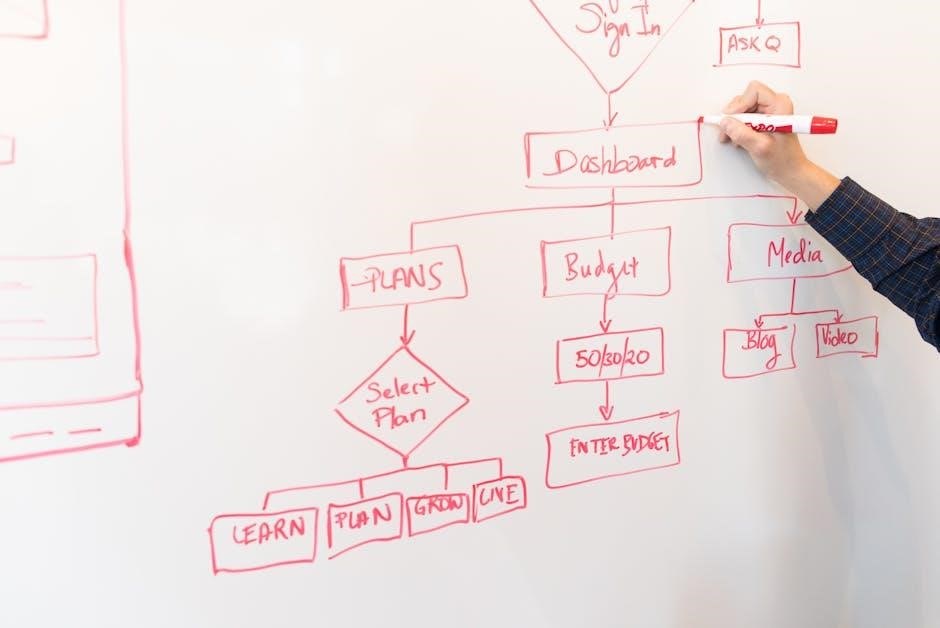

STEM Education Programs and Reorganization

Recent initiatives focus on consolidating and restructuring STEM education programs across multiple agencies – currently 114 programs across 11 agencies – to improve delivery, impact, and visibility of STEM efforts. This reorganization aims to streamline resources and enhance coordination.

Furthermore, there’s a push to support STEM teaching pathways for a diverse pool of professionals, including native-born, foreign-born, and foreign-trained individuals, addressing teacher shortages and promoting inclusivity. These efforts aim to build a robust and equitable STEM education system.

Supporting Diverse STEM Teachers

A critical need exists to bolster the STEM teacher workforce by actively supporting pathways for educators from varied backgrounds. This includes native-born citizens, individuals born abroad, and those with STEM training received internationally. Addressing teacher shortages requires a broad recruitment strategy.

Prioritizing teacher diversity is equally vital, ensuring that all students have role models who reflect the richness of our society. These inclusive efforts aim to create a more equitable and representative STEM learning environment for all preschoolers.

The Role of Reading and Singing in STEM

STEM concepts are beautifully reinforced through books and songs, sparking curiosity and providing opportunities to discuss ideas with young children.

STEM-Related Books for Preschoolers

Introducing STEM through literature is a fantastic way to engage preschoolers! Books can subtly introduce concepts like measurement, building, and even basic chemistry. Look for titles that encourage observation and questioning about the world around them. Stories about structures, patterns, or simple machines can spark curiosity.

Reading aloud provides a shared experience and vocabulary building. Don’t hesitate to pause and ask questions like, “What do you think will happen next?” or “How is this building strong?” These interactions foster critical thinking skills, essential for early STEM development.

Songs that Teach STEM Concepts

Utilizing music is a playful method to reinforce STEM ideas for preschoolers! Songs can introduce concepts like counting, shapes, and patterns in a memorable way. Simple tunes about building, sorting, or comparing sizes can be incredibly effective. Repetitive lyrics aid in retention and understanding.

Create or find songs that encourage movement and interaction. For example, a song about building could involve actions like stacking and balancing. Music makes learning fun and accessible, fostering a positive attitude towards STEM exploration.

Talking About STEM Concepts with Children

Engage preschoolers in conversations about their observations during STEM activities. Ask open-ended questions like, “What happens when we mix these?” or “How can we make this tower taller?” Encourage them to describe their thinking and problem-solving processes.

Introduce STEM vocabulary in a natural and age-appropriate manner. Explain concepts like “balance,” “size,” and “pattern” as they arise during play. Validate their ideas and foster a curious mindset, emphasizing that experimentation is key!

Assessment in Preschool STEM

Observe children’s STEM skills during play, documenting their learning journey through portfolios showcasing their work and problem-solving approaches.

Observing STEM Skills During Play

Careful observation during play reveals a preschooler’s budding STEM abilities. Note how children approach challenges in block building – do they experiment with stability, or problem-solve when structures fall?

During measurement activities, observe their comparative language (“bigger,” “smaller,” “longer”). When mixing materials, watch for curiosity and predictions.

Document instances of pattern recognition and creation. Assess their ability to articulate their thinking, even if it’s not yet fully formed. These observations provide valuable insights into their STEM development.

Documenting STEM Learning

Systematic documentation of STEM experiences is crucial. Beyond simple observation, create records of children’s explorations – photos, videos, and anecdotal notes detailing their processes and discoveries.

Capture their verbal explanations, even if fragmented, as these reveal their understanding. Focus on the how of their learning, not just the what.

These records become valuable tools for assessing progress and tailoring future activities. They also demonstrate STEM engagement to families and showcase growth over time.

Using Portfolios to Showcase STEM Work

STEM portfolios offer a dynamic way to present a child’s learning journey. Include documented observations, photos of building challenges, drawings illustrating scientific concepts, and records of pattern creation.

Portfolios aren’t just collections; they demonstrate growth and understanding over time. Encourage children to contribute to their portfolios, selecting pieces they’re proud of and explaining their work.

Share these portfolios with families, highlighting STEM skills and fostering continued exploration at home.